Our business partners are important members of our value chain, who supply the materials, parts and components necessary for the continued operation of our manufacturing enterprise. At Komatsu, we aim to build a Win-Win relationship with our business partners by making interactive efforts under a relationship of mutual trust. Along with the expansion of our global operation, our supply chain has also been expanding all over the world. Taking seriously the recent gain of momentum for the spread of CSR in the overall supply chain, we are working to realize CSR procurement globally by being proactive in providing intense support for the CSR initiatives of our business partners.

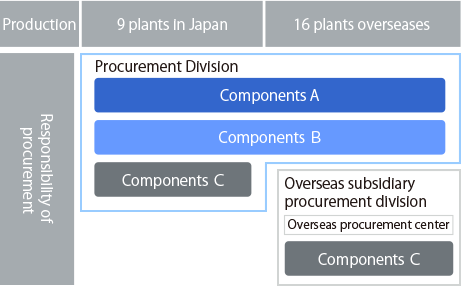

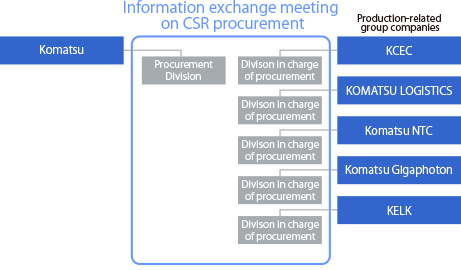

Komatsu employs a centralized procurement system where the Procurement Division deals with almost all the components and materials used in multiple plants in Japan. For overseas production, A- and B-category components as specified in the component categories described above are dealt with by the Procurement Division, and the C components are dealt with by the procurement departments of overseas subsidiaries. In addition, we have established an overseas procurement center within each site in the U.S., Europe, China, and Asia to ensure the penetration of the policies of the Procurement Division and ensure the consistency of the procurement activities of each overseas subsidiary. We are also using this system for global supply chain management and the promotion of CSR procurement. Furthermore, we hold meetings to exchange information with the procurement departments of production-related group companies on a regular basis to respond to common issues on a group-wide basis.

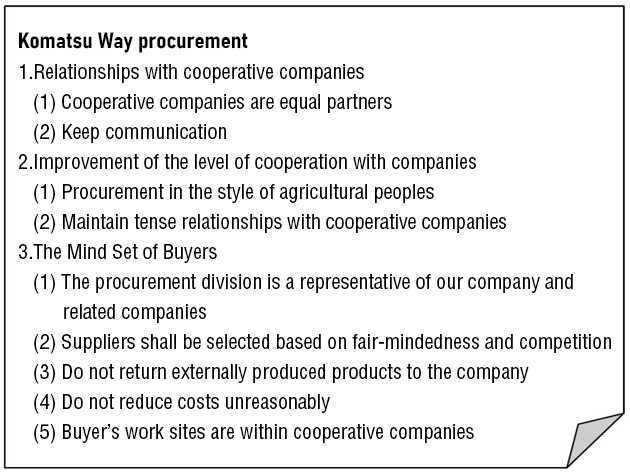

Developing procurement staff responsible for CSR procurement is also a key issue. The Komatsu Way – Procurement Edition outlines essential fundamentals for promoting global procurement, especially the core principles and code of conduct to keep in mind when working with partner companies. In addition, we have been facing significant changes in laws and regulations of Japan and other countries on business transactions, employment and labor, environmental protection, export control and other matters. Responsible persons from the procurement department are required to understand these trends and reflect them appropriately in their daily procurement activities. In 2023, Komatsu conducted compliance refresher training and human rights education for a total of 538 managers and other employees in the procurement division. This training aimed to update their understanding of CSR procurement and share the importance of further raising awareness across the entire division. Going forward, Komatsu continues to ensure thorough understanding through group training and e-learning tailored to each job class, from new employees to managers.

Komatsu's general production policy is to manufacture products directly within the area of demand. We have 46 of our 58 plants related to construction or mining equipment overseas.

Concerning components, parts, materials and other items, we are promoting local procurement proactively based on production and procurement policies that we set in accordance with the characteristics of each. Above all, for Components B and C listed below, we are expanding cross sourcing between regions to respond flexibly to changes in the international trade environment such as exchange rate fluctuations, FTA and EPA, and import/export regulations aiming for globally optimal procurement.

Production and procurement policies for components and parts used in construction and mining equipment

| Category | Definition | Production and procurement policy | Examples of parts |

|---|---|---|---|

| Components A | Key components for differentiation that determine product quality and functions | Permanent development and production in Japan (supply from Japan to the world) | Engines, transmissions, axles, hydraulic equipment, and electronic equipment |

| Components B | Components that we need to purchase intensively from certified suppliers from the viewpoints of functions, quality, and investment | Optimal procurement from 2 or 3 regions in the world | Floor parts of cabin, cooling parts, undercarriage parts, cylinders, high-pressure hoses, tires, rims, and operator's seats |

| Components C | Parts with relatively low levels of technological difficulty, which should desirably be produced or procured close to the assembly plant | Local procurement | Thick/ thin sheet-metal parts, machined parts, and cast and wrought products as materials |

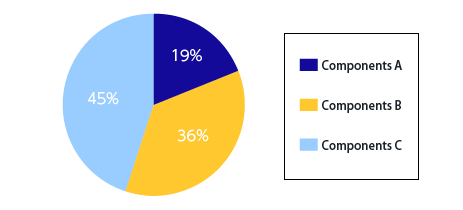

The breakdown of procurement in monetary terms in the construction and mining equipment business of the Komatsu Group in FY2023 is shown below.

Components Types by Percentage of Procurement in Monetary Terms

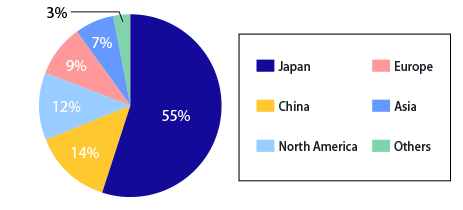

Origin of components by Percentage of Procurement in Monetary Terms

In the construction and mining equipment business, Komatsu collaborates with approximately 2,700 partner companies (primary suppliers) worldwide. From this pool, we select priority suppliers through a screening process that considers ESG, country, industry, product-specific risks, and business relevance. These evaluations include factors such as the management philosophy and ethos of top management, SLQDC* performance including development and proposal capabilities in transactions with Komatsu, the strategic and technical importance of supplied items, transaction history, and scale with Komatsu. We then form the Komatsu Midori-kai, a group of particularly critical partners, from this evaluation. The Komatsu Midori-kai currently operates in five regions: Japan, China, Thailand, North America, and Europe, and procurement from its member companies accounts for 74% of Komatsu’s total procurement by value as of FY2024. Each regional Midori-kai collaborates with local Komatsu manufacturing plants to promote region-specific activities, holding regular meetings to enhance understanding of Komatsu's business and facilitate communication between Komatsu executives and member company leaders. The annual Komatsu Midori-kai General Meeting held in Japan in November attracts participation from both Japanese and many overseas member companies. During this meeting, Komatsu executives provide business briefings and outline our global procurement policies and priority activities. To support member companies in enhancing their competitiveness, the Komatsu Midori-kai in Japan and China organizes members into groups (subcommittees) by their supply items. These groups engage in cooperative improvement activities focused on common themes such as safety, the environment, and advanced production technology. Successful improvement cases are shared among companies within the same group to facilitate the horizontal spread of knowledge and best practices.

For more information on Komatsu’s initiatives for Midori-kai member companies, please refer to the following page.

Detail of critical suppliers

| Area | Number of Critical Suppliers | |||||||

|---|---|---|---|---|---|---|---|---|

| Total | Sub-contracted*1 | Proprietary parts*2 | ||||||

| Invested by Komatsu | Highly depend on business w/t Komatsu | Invested by Komatsu | Highly depend on business w/t Komatsu | Big enterprise | Trading firm, Material | |||

| Midori-kai | Japan | 155 | 6 | 86 | 2 | 7 | 43 | 11 |

| China | 63 | 2 | 37 | 1 | 4 | 14 | 5 | |

| Thailand | 32 | 19 | 1 | 10 | 2 | |||

| USA | 44 | 1 | 15 | 1 | 19 | 8 | ||

| EU | 40 | 4 | 34 | 2 | ||||

| sub total | 334 | 9 | 161 | 4 | 12 | 120 | 28 | |

| Non Midori-kai | Japan | 1 | 1 | |||||

| USA | 1 | 1 | ||||||

| EU | 1 | 1 | ||||||

| Indonesia | 4 | 1 | 1 | 2 | ||||

| India | 18 | 4 | 14 | |||||

| Vietnum | 4 | 3 | 1 | |||||

| Philippines | 1 | 1 | ||||||

| sub total | 30 | 2 | 8 | 0 | 1 | 17 | 2 | |

| G.Total | 364 | 11 | 169 | 4 | 13 | 137 | 30 | |

Classification and breakdown of critical suppliers

| Category | Number of Company | Annual Purchase amount | |||

|---|---|---|---|---|---|

| 1 | Total Tier 1 suppliers | 2,724 | 100% | 100% | |

| 2 | Critical suppliers* |

Level-3 | 364 | 13% | 74% |

| 3 | Level-2 | 197 | 7% | 63% | |

| 4 | Level-1 | 15 | 1% | 8% | |